Mexico Market Profile

full report (PDF)

(Date of Publication: March 8, 2024)

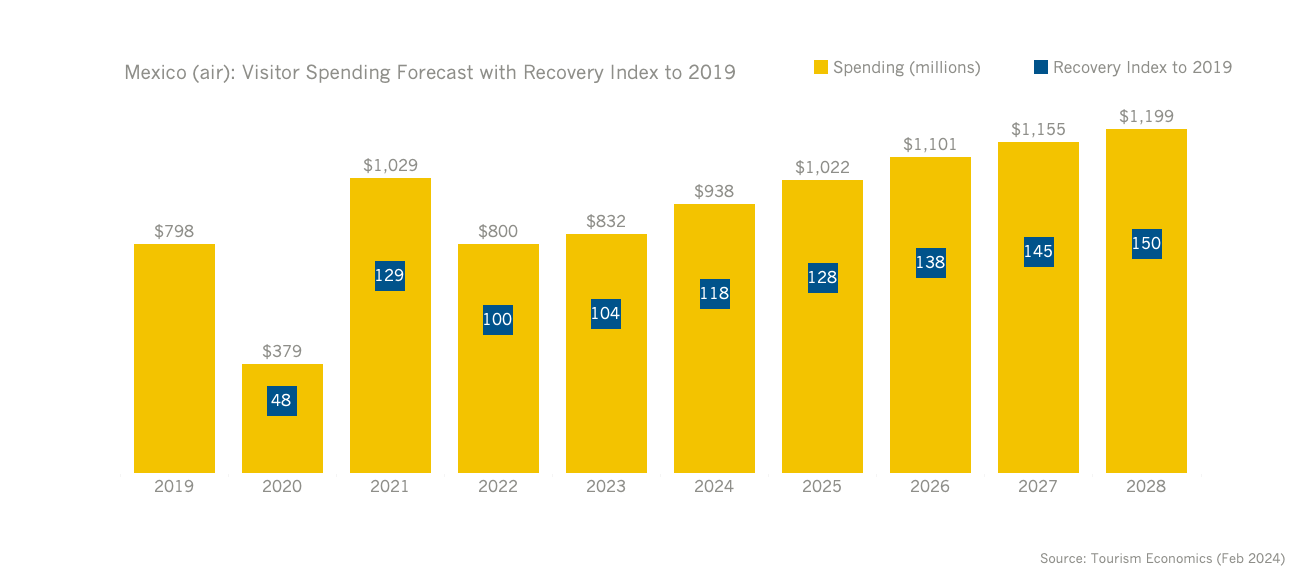

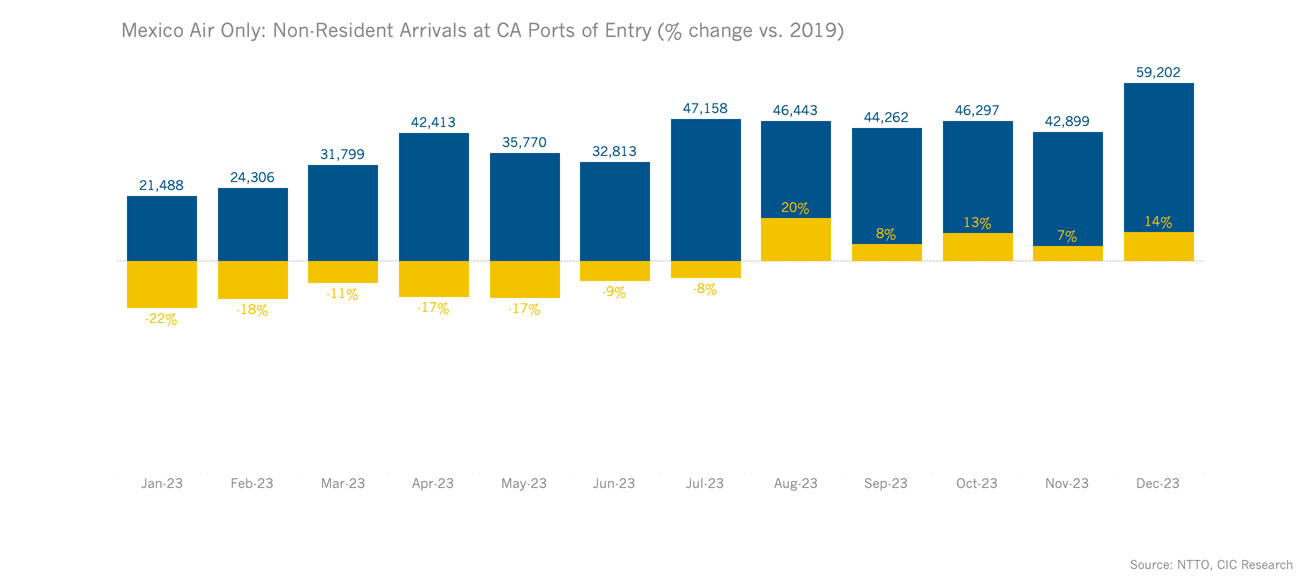

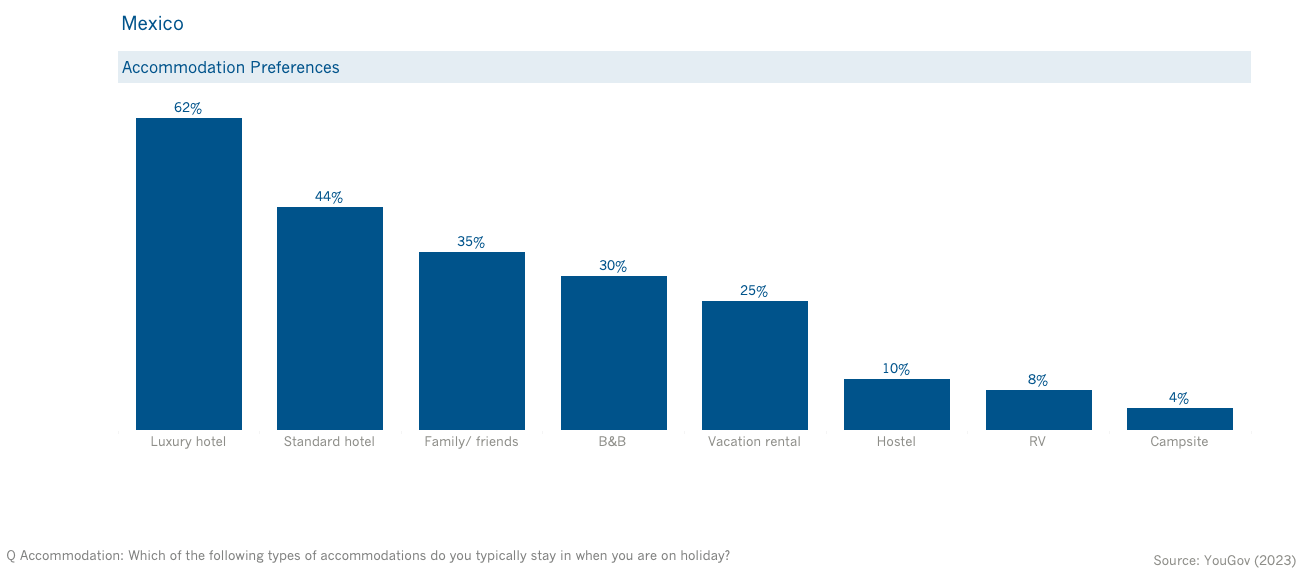

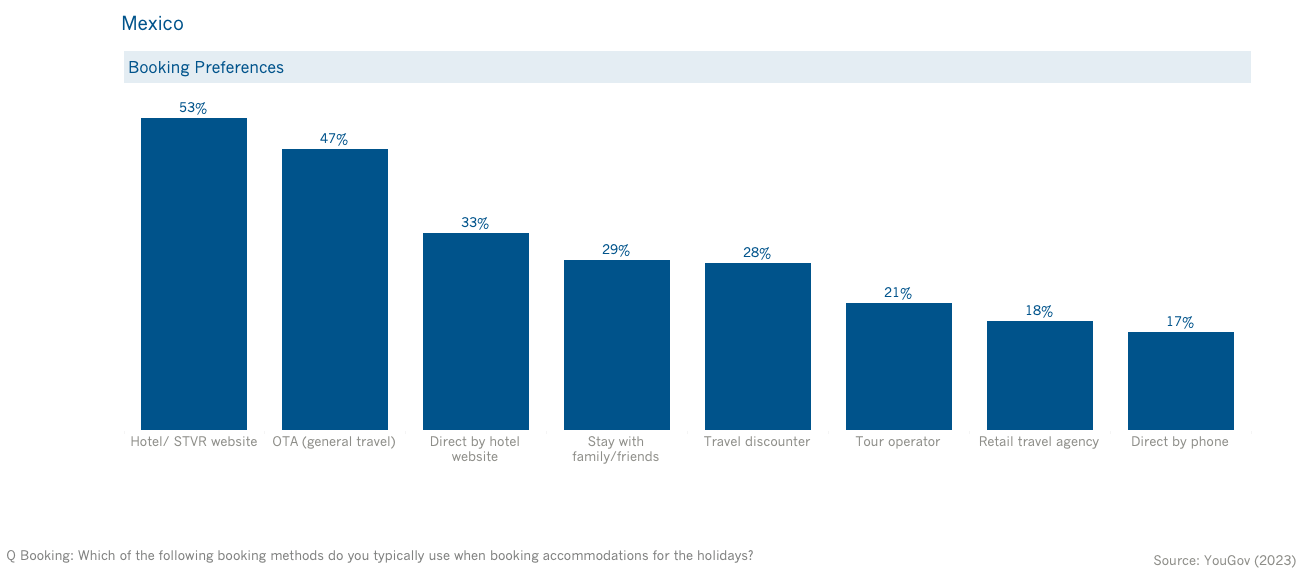

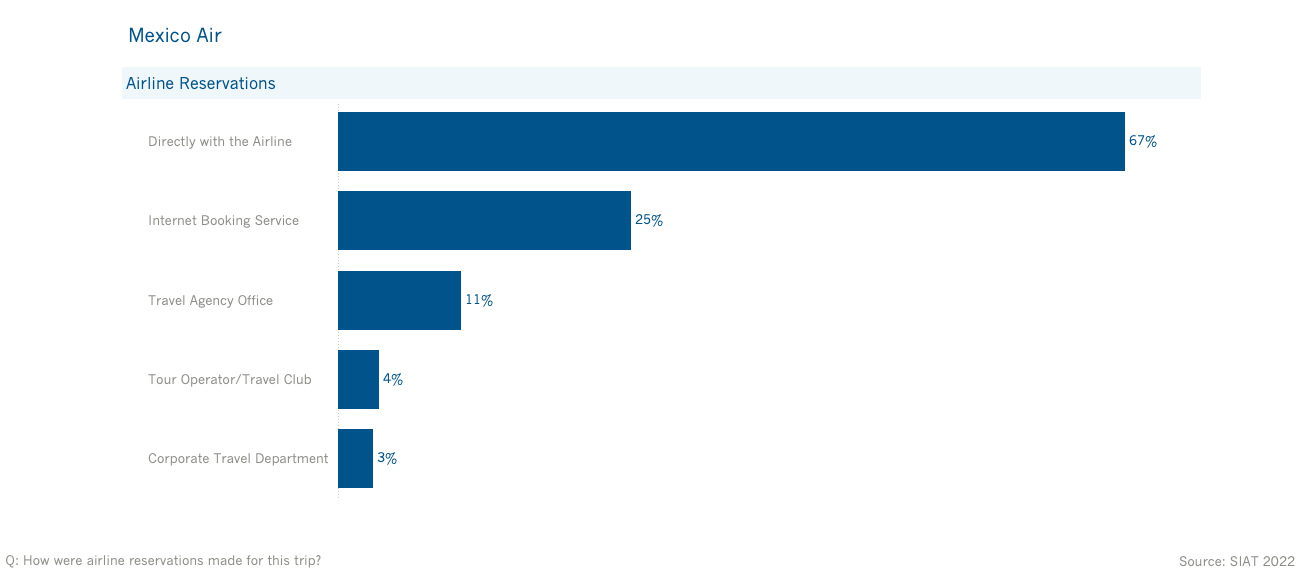

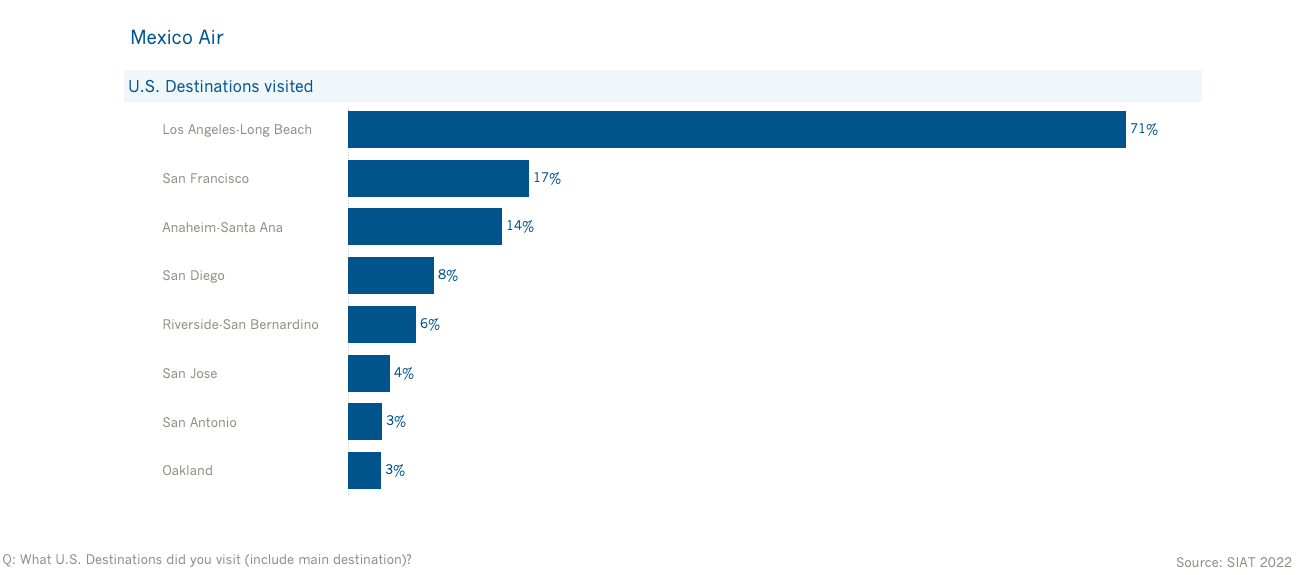

This Global Market Profile report contains three sections. The Market Landscape section offers a look at spending forecasts, arrivals, and airlift to California. The Audience Insights section includes data on travel behaviors and accommodation and booking preferences. The California Traveler and Trip Details section includes data on leisure travelers’ airline reservations and top U.S. visited destinations. For additional research download the full market report.

MARKET LANDSCAPE

AUDIENCE INSIGHTS

CALIFORNIA TRAVELER & TRIP DETAILS

;

;