Research Dashboard

2024 Economic Impact of Travel

View report

Travel Indicators Summary

View report

- Macroeconomic conditions were largely stable in December, with inflation steady at 2.7% and unemployment easing to 4.4%. Job growth remained weak, and consumer sentiment rose slightly but stayed well below last year’s levels.

- Travel sentiment in December was slightly more negative, especially among California residents. Financial outlooks for California travelers declined, while overall U.S. consumer sentiment remained stable. Interest in travel stayed high, though intent to travel abroad softened.

- At the state level, hotel performance was relatively flat in December, with slightly higher occupancy and marginally lower ADRs. California ended 2025 with room demand up ~1% and revenue up 2%, outperforming the U.S. overall. Group demand softened in December but finished the year up 3% in demand and 6% in revenue.

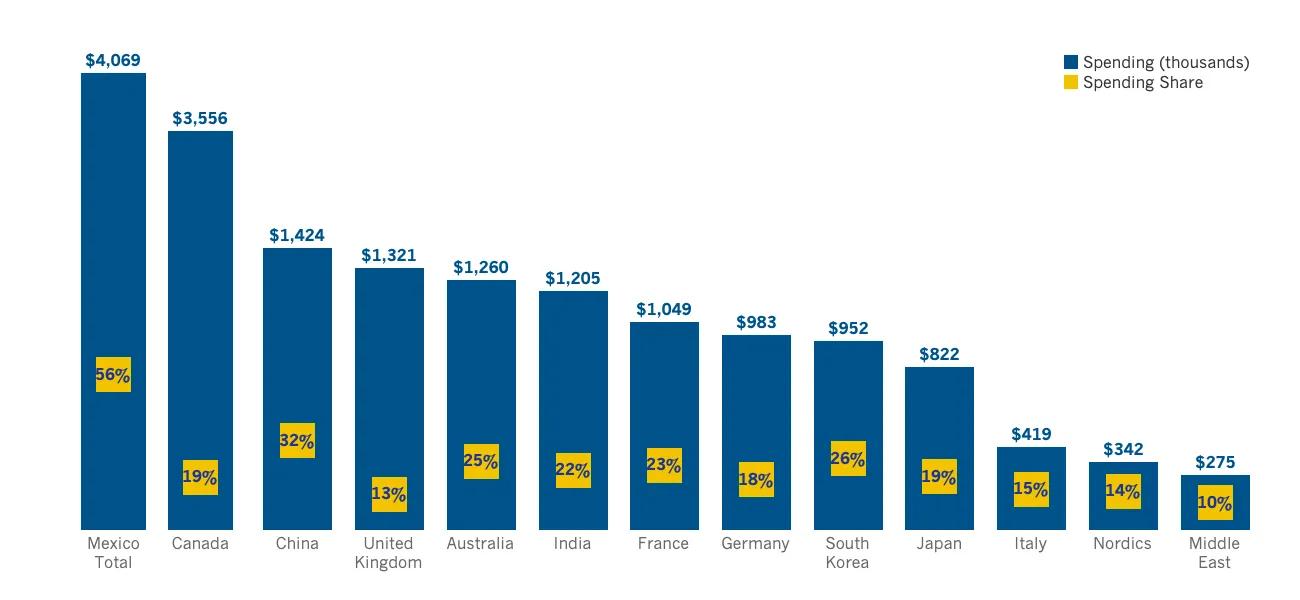

- While overall international airlift to California grew modestly in 2025, arrivals from priority markets declined in December. Canada and Northern Europe saw the largest pullbacks, though Canada’s decline eased. Mexico, Japan, and Italy ended the year positively, remaining bright spots for the state’s travel economy.

Source: Visit California and third-party data sets

Visitation and Spend Forecast

View report

Total annual travel spending & visitation

Source: Tourism Economics

State and Regional Lodging Forecast

View reportSource: Tourism Economics

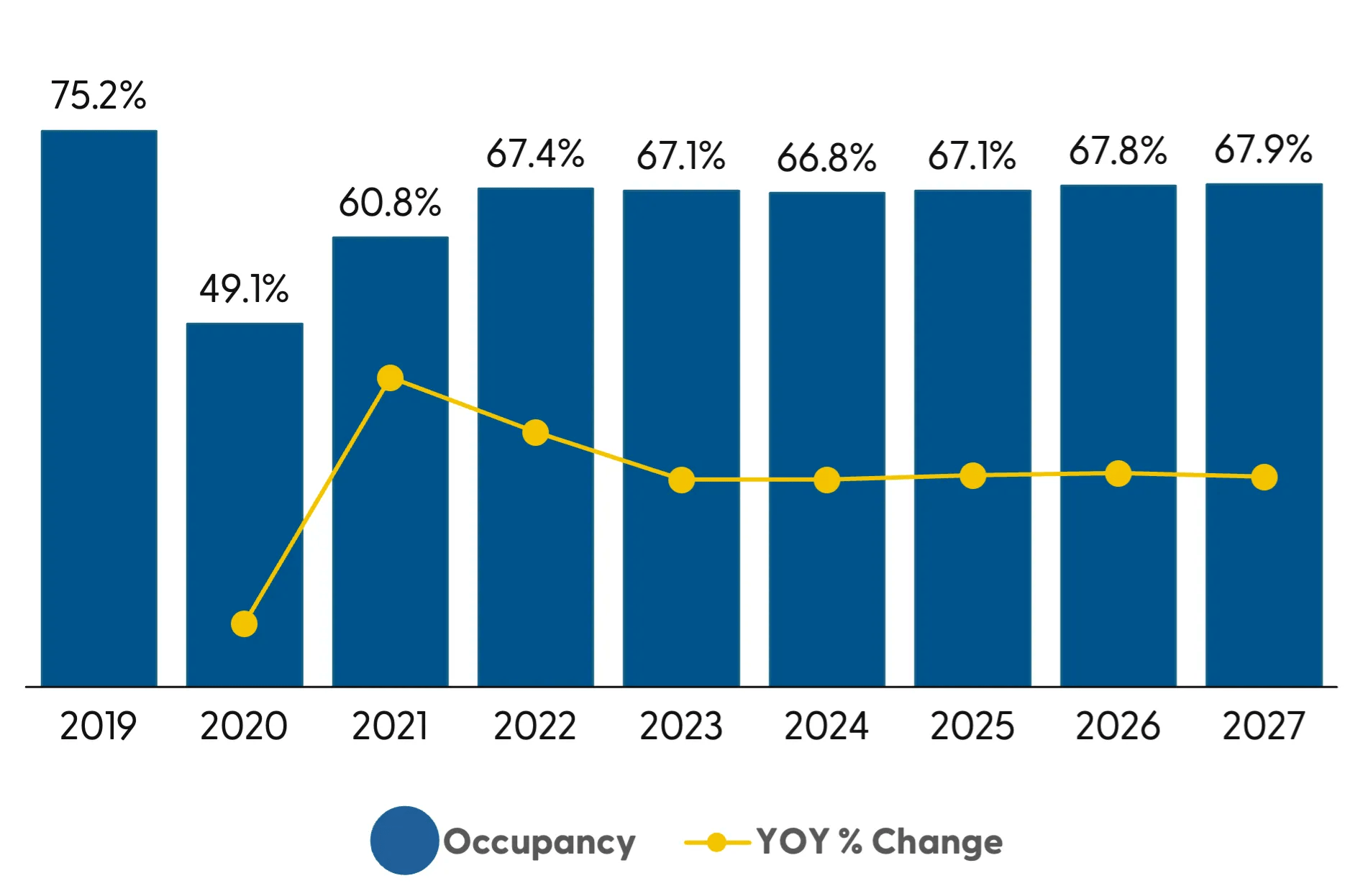

Lodging Performance

View report

Hotel Occupancy

Source: CoStar

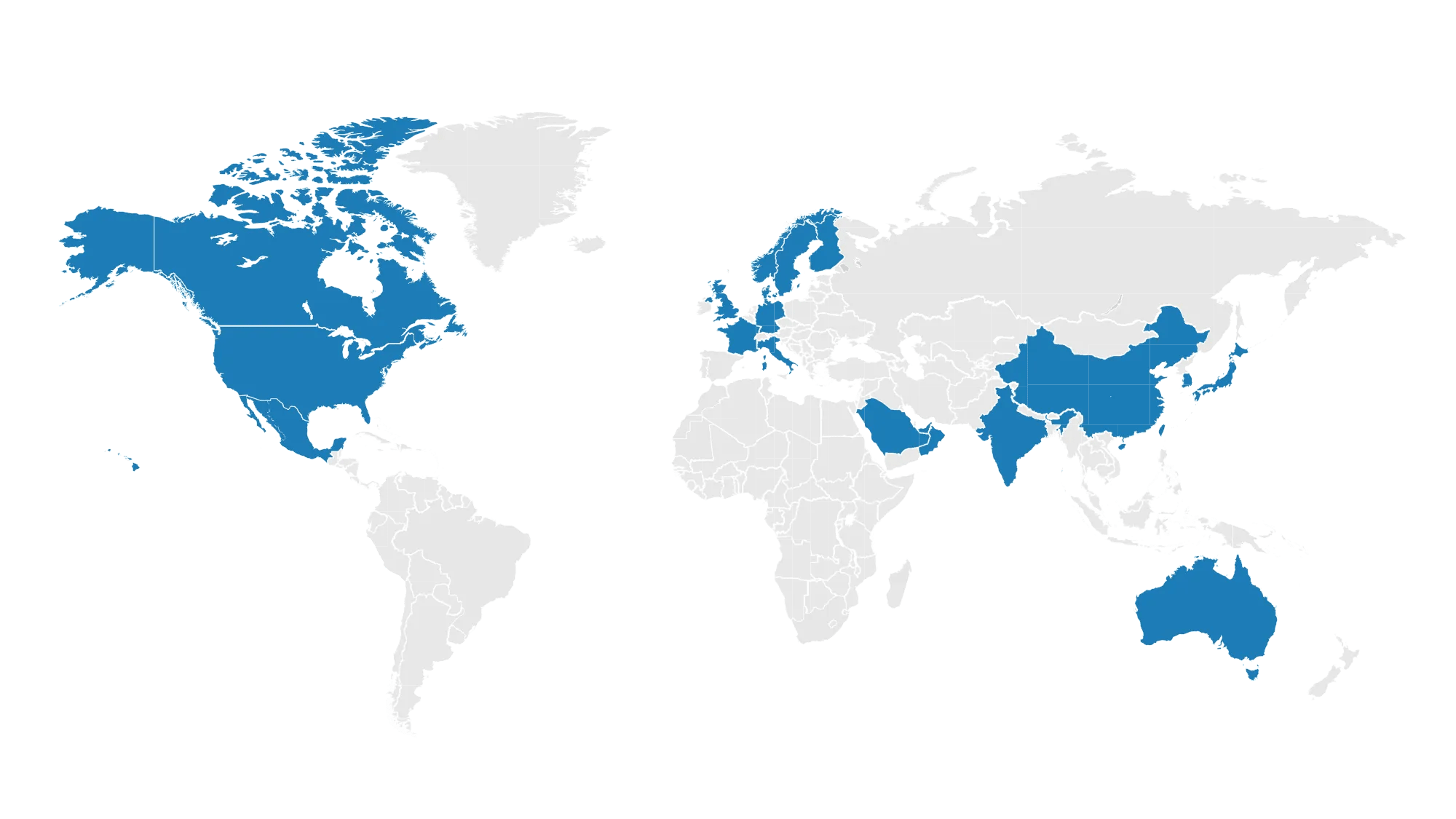

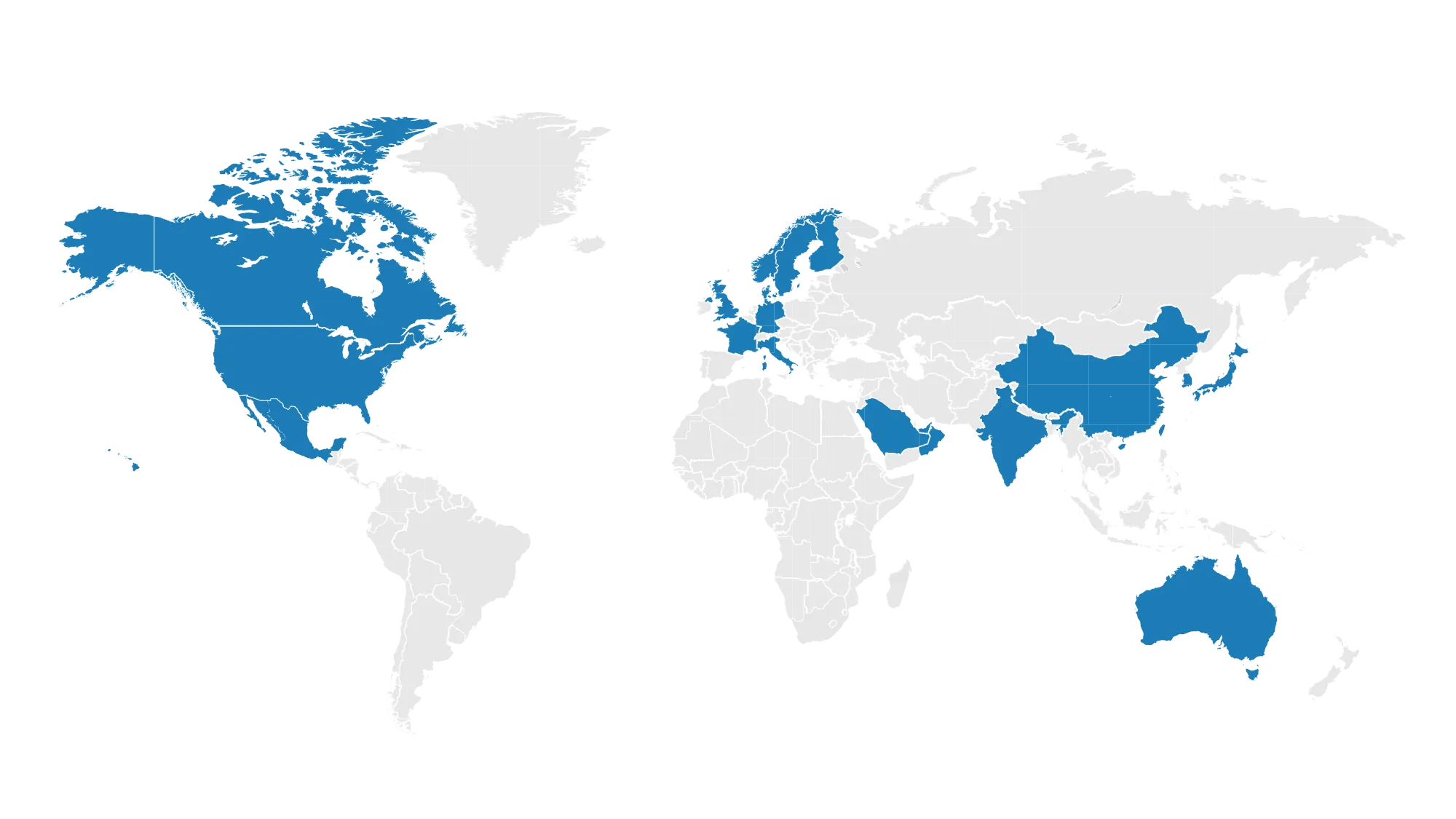

Global Market Profiles

Airlift

View reportSource: Cirium

International Arrivals

View report

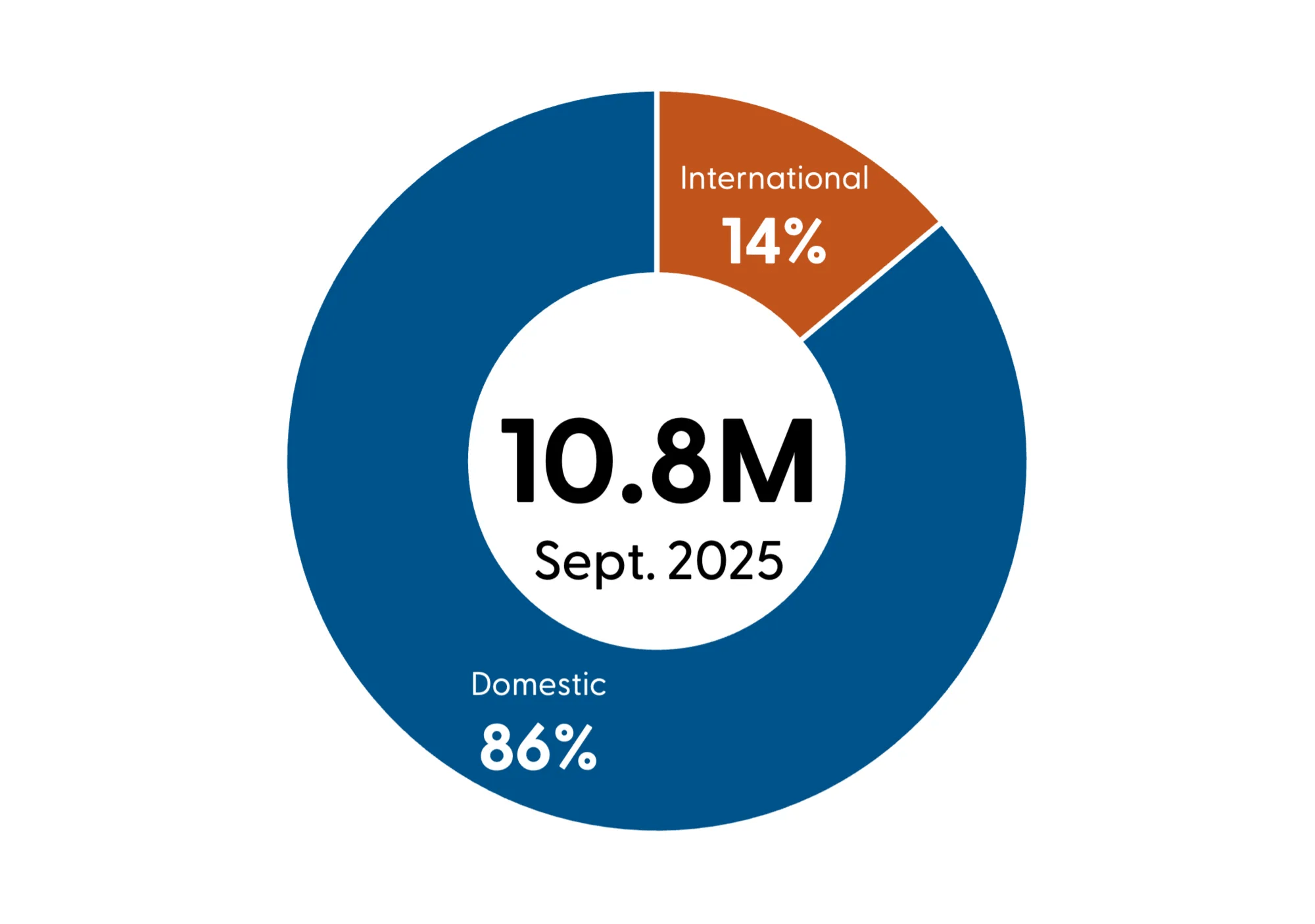

Non-resident arrivals at California ports of entry

Source: NTTO, CIC Research

Airport Passenger Traffic

View report

Airport Passenger Traffic by Month

Source: Individual Airports

International Market Share

View reportSource: Tourism Economics

Resident Sentiment

View report

Resident perception of travel & tourism

Source: Omnitrak