Outlook Forum and Winter Board Meeting 2026

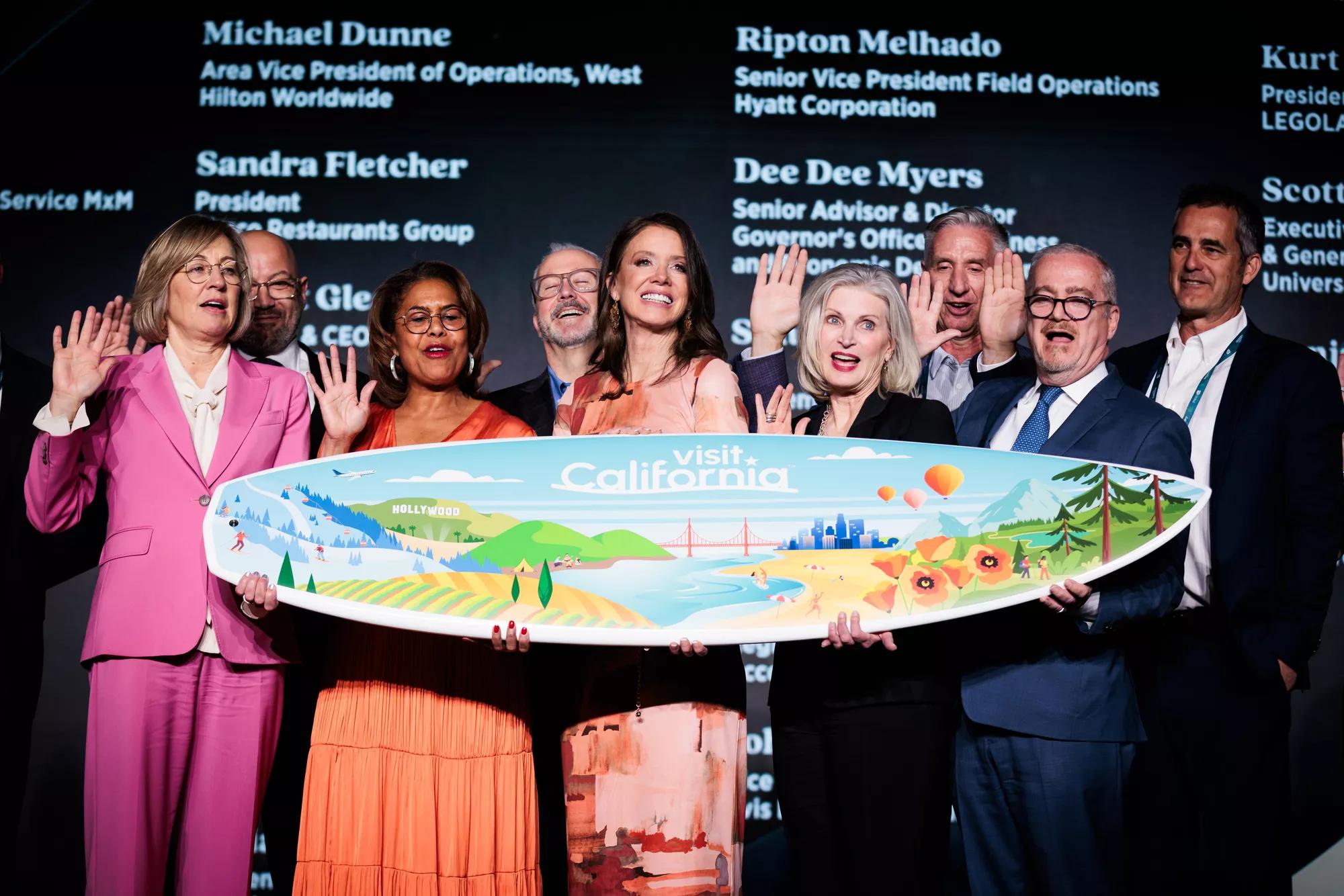

Outlook Forum unites California’s tourism industry for three days of networking, education and inspiration

Visit California's marketing renewal passes with record turnout

The record-setting 98.3% approval rate is a clear mandate from the industry

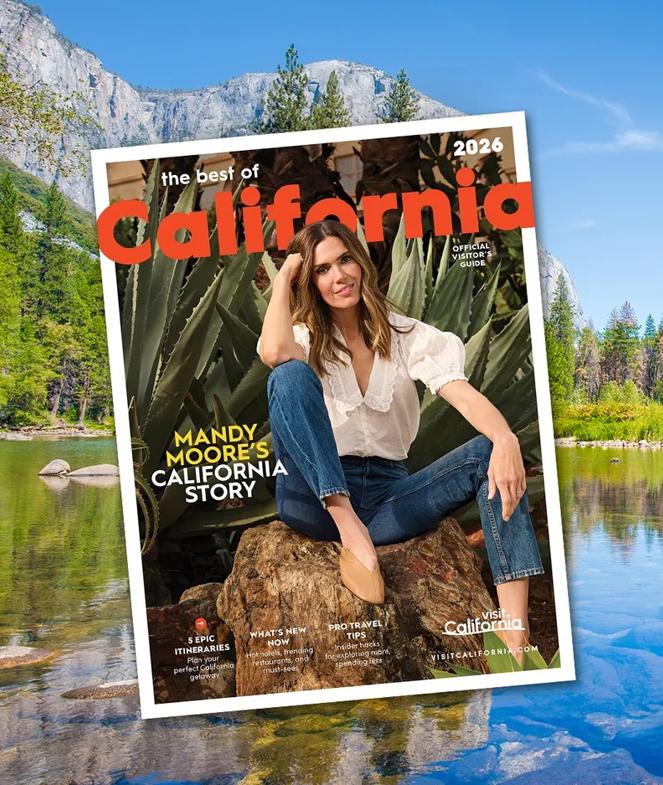

Destination stewardship: California leads the way

Read Visit California’s guide to GSTC, the global standard for sustainable practices

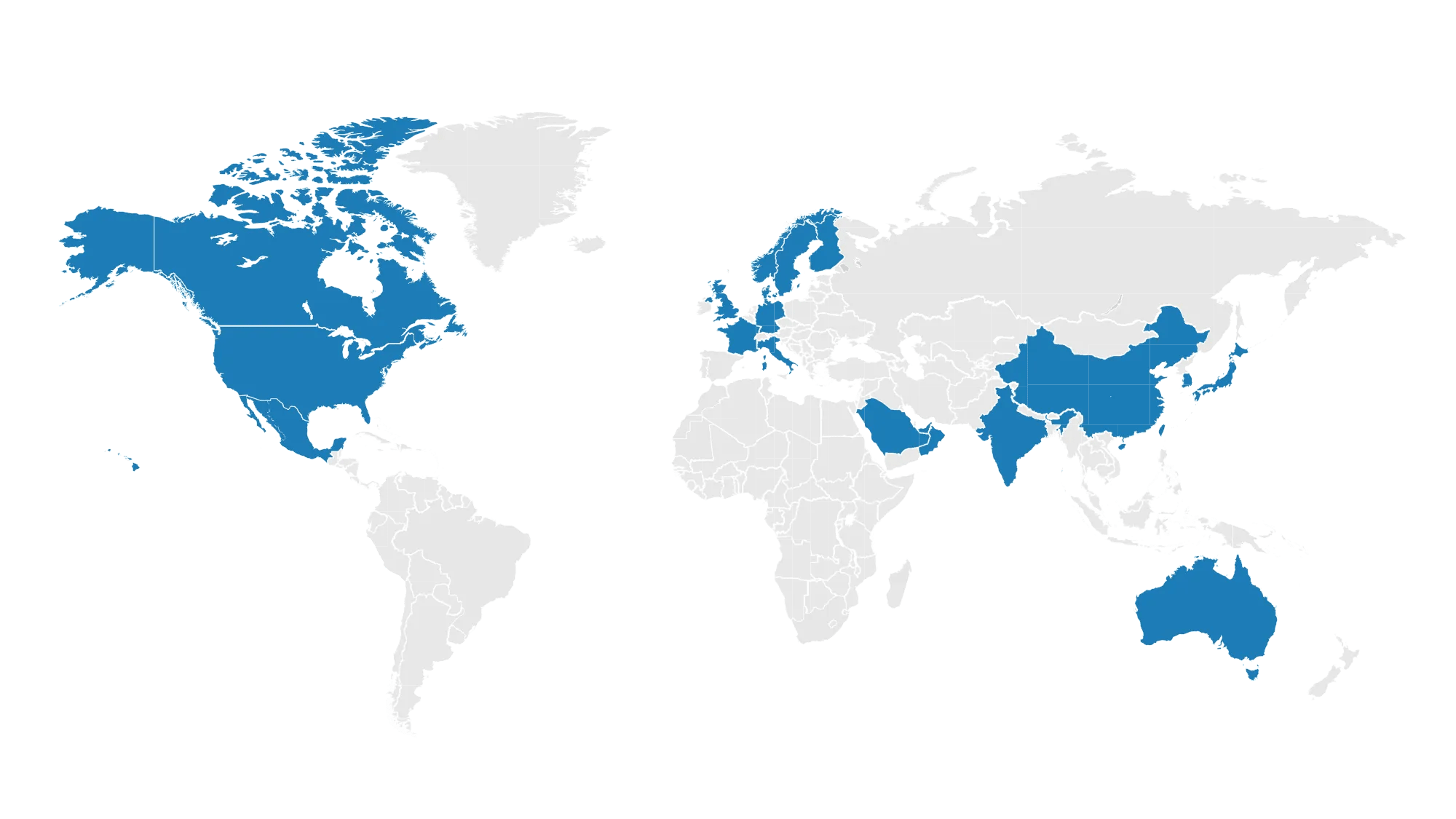

Driving demand for California travel

Get involved

Leverage content, research and networking initiatives that put California’s tourism industry first.

Led by California’s tourism industry

Newsroom

Stay up to date on the latest industry headlines